Not understanding the basics of how a plan works can significantly drive up healthcare costs for your employees. If you or a loved one has faced unexpected medical bills, you’ve felt the stress and limbic system response.

There are a ton of health insurance gotchas, but I’ve narrowed this down to 10 things every employee should know about their health plan. These are key points to hit during open enrollment—and throughout the year.

1. Health plans vary by employer!

Employees don’t realize that health plan design is unique to each employer, and even the "same" health plan can vary by employer. A common behavior during enrollment is to poll friends and family to try to determine the “best” health plan. That’s why it’s so important for your company to educate employees about the specifics of your plan.

2. How a deductible works

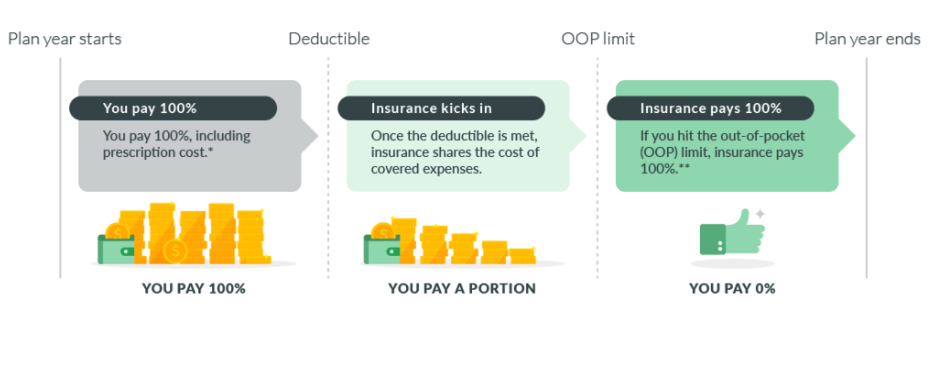

Provide a foundation by explaining how deductibles and the out-of-pocket limit work.

* In-network, covered preventive care is typically paid 100% by insurance, regardless of where you stand with your deductible.

** Insurance pays 100% of covered, in-network expenses. You must still continue to pay your monthly premiums to maintain your coverage. The deductible and OOP costs reset on the renewal date of your company’s plan, which may or may not align with the calendar year.

3. What counts toward a deductible

Does: Money you pay out-of-pocket for health care services that are a covered benefit of your health plan count towards your annual deductible. Coinsurance also counts.

Doesn't: Copays don't count toward your deductible (although they do count towards the out-of-pocket limit). The monthly premium cost doesn't apply towards your deductible, either. Think of your premium like a monthly gym membership—you pay for the right to go regardless of whether you use it.

Also, be aware, depending on your health plan's rules, the amount paid toward an out-of-network deductible might not count toward the in-network deductible.

4. Always ask, "Is this in my network?"

A very common, costly mistake is asking a provider, "Do you take my insurance?" While many doctors and hospitals will accept your insurance, it doesn't mean they are in your network. And, as the insurance policyholder, it's your responsibility to make sure you only use in-network providers and facilities.

Insurance carriers and health care providers pool together in advantageous networks. A network is a group of healthcare providers (including doctors and hospitals) who work for pre-negotiated, lower rates.

5. What counts toward an out-of-pocket (OOP) limit

Does: Costs that contribute towards your out-of-pocket (OOP) limit include deductibles, copays, coinsurance for eligible, in-network medical expenses.

Doesn't: The OOP limit does not count premiums, balance billing amounts for out-of-network providers or other out-of-network costs, or expenses that aren't covered by the health plan.

6. What happens when you go out-of-network (OON)

When you go out of network, you may pay a larger part of the cost-share for those services than you would for the same services provided by an in-network provider. This may include the deductible, coinsurance, and other out-of-pocket amounts.

An out-of-network provider can bill you for anything over the amount your plan allows. This is called balance billing. A network doctor has agreed not to do that.

What you pay when you are balance billed doesn’t count towards your deductible or out-of-pocket (OOP) maximum. And some plans don’t cover any out-of-network benefits (except in the case of an emergency).

NOTE: On July 1, 2021, the U.S. Departments of Health and Human Services (HHS), Labor, and Treasury issued an interim rule designed to restrict surprise billing for emergency services, as well as other out-of-network charges without advance notice.

7. Preventive care is... free!

This is good news that most employees don't realize. This is one of the patient protections in the Affordable Care Act (I may need to update this one in November. TBD). Health plans cover 100% of preventive care—regardless of where you stand with your deductible. Preventive care typically includes:

- All well-baby visits

- One wellness visit/annual physical per year per adult

- Flu shots and vaccinations

- Prostate exams

- Mammograms

- Well-woman visits

8. Qualifying Life Event (QLE)

When it comes to making health plan elections or changes, employees typically don't understand the strict rules are from the IRS, not you as the employer. It's useful to specifically call that out:

Due to IRS guidelines, you cannot make changes to your health insurance benefits outside of your employer's annual open enrollment period unless you experience a qualifying life event (QLE).

A QLE is a change in your situation—like getting married, having a baby, or losing health coverage—that can make you eligible for a special enrollment period. But the clock is ticking...

9. How a Consumer-Driven Health Plan (CDHP) works

Assuming your company has a good plan design, the annual out-of-pocket costs associated with a CDHP are typically significantly lower than a traditional PPO. However, you pay 100% out-of-pocket until you meet your plan's deductible (and cost-sharing kicks in with your insurance).

Personally, I'm a big fan of the CDHP/Health Savings Account (HSA) combination—you can read why here. You just don't want your people to be caught off guard.

10. Switching from an FSA to an HSA

For employees moving from a Flexible Spending Account (FSA) to a Health Savings Account (HSA), don't get tripped up by an FSA grace period or carryover. You can't contribute to an HSA and have a general-purpose FSA for overlapping months. (Also see HSA and FSA in the Same Year).

I could go on and on and on...

In year two of the pandemic, many employees have moved, so remind your people to verify their address. And it's always a best practice to remind your people about naming a beneficiary, too.

I hope you found this information helpful. Employee benefits education is something Lumity handles on behalf of our clients, but it's a personal passion of mine. Healthcare and benefits are extremely complicated, and I like to think I do my part to help folks avoid costly mistakes.